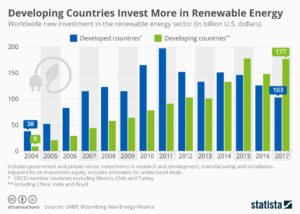

In today’s rapidly evolving investment landscape, diversification is key to managing risk and enhancing returns. One of the most promising areas for diversification is renewable energy. As the world shifts towards sustainable practices, renewable energy investments offer both growth potential and stability. This article will guide you through the process of incorporating renewable energy into your portfolio, highlighting key considerations, strategies, and benefits.

1. Understanding Renewable Energy Investments

Renewable energy encompasses various sources, including solar, wind, hydro, and geothermal power. These sources are considered sustainable because they are replenished naturally and have a lower environmental impact compared to fossil fuels. Investing in renewable energy can involve direct investments in energy projects, purchasing stocks of companies in the sector, or investing in renewable energy-focused funds.

2. Assessing the Benefits

1. Growth Potential: The renewable energy sector is expected to grow significantly as governments and businesses commit to reducing carbon emissions. This growth can translate into substantial returns for investors.

2. Risk Mitigation: Renewable energy investments can reduce the volatility of your portfolio. They often have lower correlation with traditional energy markets, offering a hedge against fluctuations in oil and gas prices.

3. Long-Term Stability: Renewable energy projects typically have stable cash flows, supported by long-term contracts and government incentives. This stability can provide consistent returns over time.

4. Positive Environmental Impact: Investing in renewable energy supports the transition to a more sustainable energy system, aligning your investments with broader environmental and social goals.

3. Investment Strategies

**1. Direct Investments: Investing directly in renewable energy projects involves funding specific initiatives like solar farms or wind turbines. This approach can offer high returns but requires a thorough understanding of the project’s viability and risks.

**2. Stock Investments: Investing in companies that produce or utilize renewable energy is a more accessible way to gain exposure to the sector. Key players include solar panel manufacturers, wind turbine producers, and utility companies focused on renewable energy.

**3. Exchange-Traded Funds (ETFs): Renewable energy ETFs pool investments in various companies and projects within the sector. They provide diversification within the renewable energy space, reducing individual stock risk and offering exposure to a broad range of companies.

**4. Mutual Funds: Similar to ETFs, renewable energy mutual funds invest in a diversified portfolio of renewable energy assets. They are managed by professionals who select and manage the investments, providing a hands-off approach for investors.

**5. Green Bonds: These bonds are issued to finance renewable energy projects and other environmentally friendly initiatives. They offer fixed returns and can be a stable addition to your investment portfolio.

4. Evaluating Opportunities

**1. Market Trends: Stay informed about market trends and technological advancements in renewable energy. Innovations and regulatory changes can significantly impact the profitability of investments.

**2. Regulatory Environment: Understand the policies and incentives that support renewable energy. Government subsidies, tax credits, and renewable energy mandates can enhance the attractiveness of certain investments.

**3. Company Fundamentals: When investing in stocks, evaluate the financial health, management team, and growth prospects of renewable energy companies. Strong fundamentals can indicate a more stable investment.

**4. Project Viability: For direct investments in renewable energy projects, assess the project’s feasibility, location, and potential returns. Conduct due diligence to ensure the project aligns with your investment goals.

5. Managing Risks

**1. Market Volatility: While renewable energy investments can offer stability, they are not immune to market fluctuations. Diversify your investments within the sector to mitigate risk.

**2. Technological Risks: Renewable energy technologies are rapidly evolving. Stay updated on technological advancements and be prepared to adjust your investment strategy accordingly.

**3. Regulatory Risks: Changes in government policies or incentives can impact the profitability of renewable energy investments. Monitor regulatory developments to anticipate potential effects on your investments.

**4. Project-Specific Risks: Direct investments in renewable energy projects carry risks related to project execution, financing, and operational performance. Thoroughly vet projects and consider investing in established, well-managed initiatives.

6. Conclusion

Diversifying your portfolio with renewable energy investments offers a unique opportunity to balance growth potential, risk mitigation, and positive environmental impact. By understanding the various investment strategies, evaluating opportunities, and managing risks, you can effectively integrate renewable energy into your investment strategy. As the world continues to embrace sustainability, renewable energy investments may become a cornerstone of a resilient and forward-thinking portfolio.